This is a new era for Microsoft (NASDAQ: MSFT). Under the leadership of former CEO Steve Ballmer, the company has experienced a failed decade, failing to adapt to the shift to mobile applications, lagging behind competitors – especially smarter Mobile phones and tablets, alphabets for search advertising and browser shares, and mobile operating systems. The company has maintained its dominance of productivity tools with the Windows desktop operating system and Microsoft Office suite.

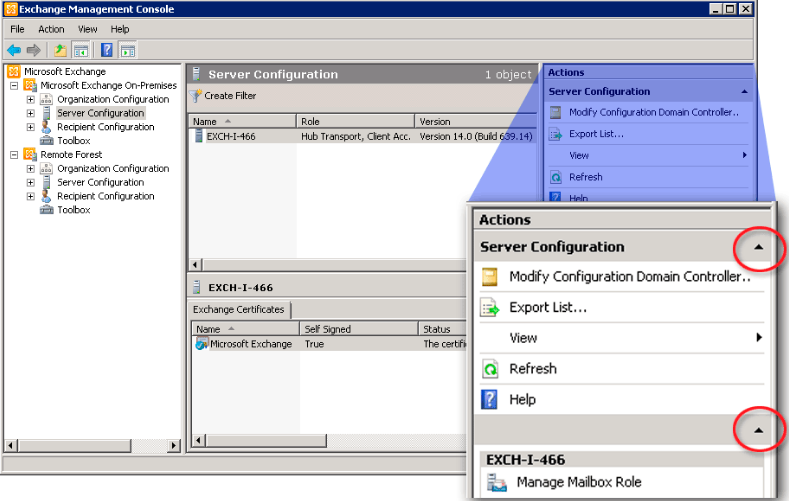

The new chief executive officer Satya Nadella led the stock recovery through a two-pronged action plan. First, the company is struggling to convert its users of operating systems and software into subscription-based billing. Second is through its Microsoft Azure program to increase its influence in the high-growth cloud computing industry.

Nadella has been mostly successful, under his leadership shareholders have made a huge return. But could anything go wrong? Here are three business-specific risks management noted in its last quarterly statement.

The continued shift from desktop to mobile. While this risk is nothing new – in fact, this is why Ballmer is no longer the chief executive – the transition from desktop to mobile is a risk for Microsoft. In 2016, we crossed the Rubicon for both mobile and desktop devices – StatCounter found that, for the first time, mobile devices have surpassed PCs for surfing the Internet. Microsoft’s mobile operating system market share is small compared to its desktop operating system share. Earlier efforts by Ballmer to design a vertically integrated smartphone by buying hardware-maker Nokia Mobility ended in a $7.6 billion writedown. Nadella finally pulled the plug on this experiment.

Nadella’s solution has two aspects: It works with the large smartphone operating system company Apple and the Letter Company to provide subscription-based applications for Office-based software. In larger tablets, Nadella continued (and improved) Ballmer’s vision by vertically integrating its Surface series of tablets. However, management wants you to know that the changing browsing style from desktop to mobile is still at risk.

Competitors with different revenue models. Like most companies, Microsoft mostly uses first-party business models: those who make the money pay Microsoft directly for software. Competitors, most notably Alphabet, provide third-party business models. Microsoft recently submitted in 10Q pointed out: Other competitors develop and offer free applications, online services and content, and make money by selling third-party advertising. Advertising revenue funds development of products and services these competitors provide to users at no or little cost, competing directly with our revenue-generating products. [emphasis added]

Microsoft faces further threats from its rival Microsoft Office suite of products as part of its corporate customer-tailored solutions. A recent article in The Wall Street Journal pointed out that CFOs are increasingly replacing Excel with enterprise resource planning (ERP) and customer relationship management (CRM) systems from providers such as Salesforce, Oracle and SAP. Microsoft is competing with ERP and CRM companies through its Microsoft Dynamics products. In the first quarter, Microsoft’s revenue grew 13%.

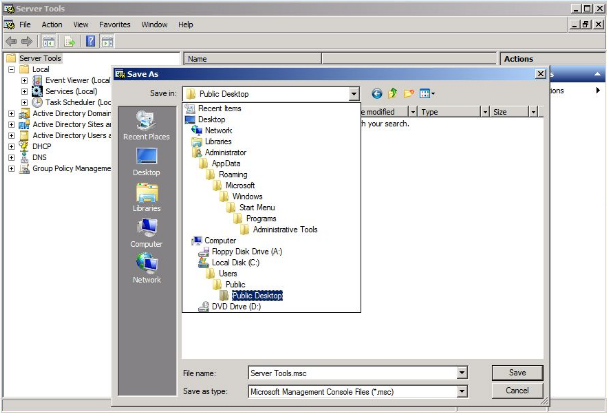

Issues with its own revenue model. Nadella has done an admirable job of converting Microsoft users to subscription-based products, Office 365. However, most Microsoft users are still licensed versions. License-based revenue is more unbalanced because it requires a compelling new release to induce consumers to upgrade. In addition, having multiple versions of the operating software requires a higher level of personnel to upgrade, patch and other software fixes.

Investing means taking risks. Like all stocks, there is also a risk to investing in Microsoft. However, Nadella is working to mitigate these key risks while focusing on growth opportunities in the cloud. Microsoft’s recently released first quarter report said that cloud-based Azure revenue increased 90%. Seeking Microsoft to continue consolidating its recent success and continue its strong run for its shares.